U.S. manufacturers’ 46-plane output dwarfs European rival’s 19 deliveries, signaling production momentum and competitive shift.

Boeing outpaced Airbus across key metrics during January, handing over 46 commercial aircraft while its European competitor delivered 19 planes. The U.S. manufacturer also captured 103 net orders versus fewer than 50 for Airbus, marking a decisive opening month that positions Boeing ahead financially as aircraft payments arrive primarily upon delivery.

The performance extends Boeing’s 2025 turnaround, when it secured more net aircraft orders than Airbus for the first time in nearly a decade. January’s results reflect operational gains following years of manufacturing slowdowns and regulatory oversight that had constrained production capacity.

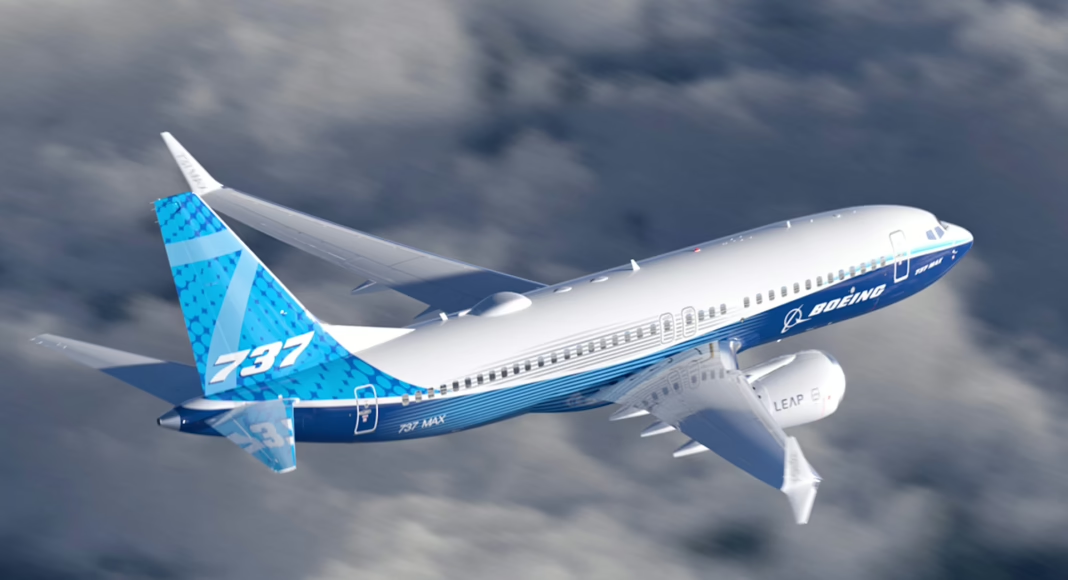

Boeing’s 737 MAX program anchored the delivery figures, with 38 of the 46 aircraft coming from the narrowbody line. The manufacturer also handed over five 787 Dreamliners and several other models. Airbus delivered 15 A320neo family jets, three A220s, and one A350 during the period.

Leasing companies drove a substantial portion of Boeing’s order activity in January, accounting for much of the 107 gross commitments recorded before four cancellations. The lessor participation signals confidence in sustained aircraft demand despite delivery slots stretching multiple years into the future.

Boeing President and CEO Kelly Ortberg acknowledged the progress in a press release about the company’s 2025 fourth-quarter results: “We made significant progress on our recovery in 2025 and have set the foundation to keep our momentum going in the year ahead.”

The 737 MAX family has returned to steady operations following extensive regulatory reviews, though production remains subject to oversight and output restrictions. Additional MAX variants await final certification, a timeline that could influence delivery rates through 2026.

Boeing faces a critical juncture with its 777X program, which has experienced repeated delays. The manufacturer is targeting a production-standard aircraft flight this year, a necessary milestone before certification and eventual service entry. Success would bolster Boeing’s competitive position in the long-haul segment, where it competes directly with Airbus’s A350.

The commercial aviation sector continues to operate under supply constraints, with manufacturers unable to fully satisfy recovering passenger demand. Bottlenecks persist across engine production, component supply chains and labor availability, restricting output even as airlines advance fleet expansion plans.

This supply scarcity has shifted airline procurement strategies. Rather than emphasizing near-term price negotiations, carriers now prioritize securing delivery positions later this decade. Airlines and leasing firms demonstrate willingness to commit years ahead, recognizing that available slots carry increasing value as lead times extend.

For 2026, Boeing’s trajectory depends on sustaining production increases while meeting heightened regulatory standards. Airbus is pursuing a measured strategy, emphasizing supply-chain stability and incremental rate growth over new platform launches. Both manufacturers face a year where consistent execution will prove more determinant than headline order announcements.

Airbus maintains a larger overall backlog despite Boeing’s January advantage. The month-to-month performance variation reflects supply chain stabilization and certification milestone progress rather than permanent market position shifts. As both manufacturers work through constraints, the competitive dynamic remains tied to operational execution capabilities.

Key Takeaways

- Boeing delivered 46 commercial aircraft in January versus Airbus’s 19, establishing an early financial lead as most aircraft payments trigger upon delivery.

- The 737 MAX drove Boeing’s output with 38 deliveries, while leasing companies fueled 103 net orders, reflecting confidence in long-term demand.

- Boeing’s 777X program targets a production-standard flight in 2026, a critical step toward certification and competition with Airbus’s A350 in long-haul markets.

- Supply chain bottlenecks across engines, components, and labor continue limiting global aircraft production, reshaping airline procurement toward long-term delivery slot priorities over near-term pricing.